New tech leadership emerges as giants' growth slows

Tech investors should look for the next big thing.

Investors' infatuation with a few well-known technology companies is starting to cost them, as new leadership emerging from the dynamic industry produces some of the best stock performance. While investors cling to the biggest or most hyped tech names, including Apple, Google and Amazon, the industry is reinventing itself, and that's leading to disconnects in stock performance. Apple's shares have inched up 6% this year, while the Nasdaq composite index has gained 33.7%.

While it's too early to guess where the future leaders will come from, some investors aren't wasting any time trying to make sure they're positioned for where the industry goes next.

"Overall, tech investors search for best growth ideas and tend to rotate from slowing-growth companies, such as Apple the past year, for faster-growth companies," says Mike Walkley, analyst at Canaccord Genuity.

BIG STOCKS: They're not only ones behind bull run[1]

Knowing where future trends lie is critical for tech investors. Companies with the winning products or services in tech can be outsize beneficiaries in technology markets, which are often winner-takes-all, at least in the short run, before competition heats up and changes the game.

Finding growth is getting increasingly difficult to do as the industry slows overall. Fourth-quarter earnings growth by tech companies is only expected to be 4.1%, says S&P Capital IQ, the third lowest of the 10 tracked. Yet, some of the companies that are starting to show up on technology growth screens include those with:

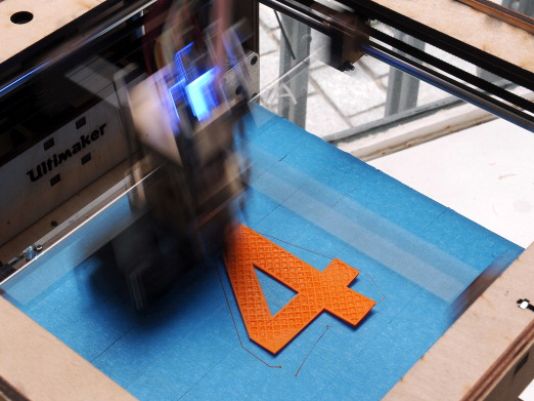

• Massive earnings growth. Some smaller companies, most of which are far from household names, are putting up blistering numbers. Other tech companies, such as 3-D printer firm 3D Systems, are tapping new areas of growth, and boosted earnings by 43% the past 12 months, due in part to pulling off 40 acquisitions the past year, says Brian Drab of William Blair. All told, there are 16 tech stocks trading on major U.S. exchanges that have posted average annual revenue and earnings growth of 20% or more the past two years, and are expected to grow that fast or faster the next two years, says S&P Capital IQ. One of those is professional social-networking company LinkedIn, which has emerged as the blue chip of the social-media stocks.

• Winning positions despite shifts in players. Smartphone handset makers may be pounding on each other to take market share, but some companies are thriving behind the scenes no matter what. Qualcomm designs the chips that go into 95% of smartphones with high-speed 4G LTE capability, says Walkley. No matter who wins, Qualcomm profits, which is clear from the company's 30% earnings growth last year. Similarly, InvenSense makes a variety of devices used to help handheld devices sense direction.

• Possible big-cap tech turnaround stories. Comebacks in tech stocks are rare, but they're still possible. Big profits can come to investors who properly pinpoint fallen tech giants that right the ship. Investors are betting on memory maker Micron, technology firm Hewlett-Packard and former Internet darling Yahoo, pushing their shares up 244%, 93% and 84%, four of the best performances this year of the tech stocks in the S&P 500. And IAC/InterActiveCorp, an early Internet pioneer that operates a variety of online media companies, is one of the companies with 30% growth in the past two years and expected to grow 30% again the next two, says S&P Capital IQ.

Social-media companies will continue to attract more investor attention as they show how fast they can grow and tech trends benefit their bottom lines, says Jim Kelleher of Argus Research. "While innovation is necessary in every sector, in technology, it is rapidly becoming 'innovate or die.' We have seen tremendous sector disruption caused by social media, enterprise mobility, analytics and big data, and virtualization and cloud," he says.