Bank hack attack: What you should do

HTTP/1.1 200 OK Server: nginx/1.2.7 Content-Type: text/html; charset=utf-8 Content-Language: en Last-Modified: Thu, 28 Aug 2014 17:20:54 GMT X-UA-Compatible: IE=Edge,chrome=1 X-Secret: cnpudnkgcnpiZXZnbUBoZm5nYnFubC5wYnogbmFxIFYganZ5eSBnZWwgZ2IgdHJnIGxiaCBuIHdiby4= Cache-Control: max-age=20 Expires: Thu, 28 Aug 2014 17:25:17 GMT Date: Thu, 28 Aug 2014 17:24:57 GMT Transfer-Encoding: chunked Connection: keep-alive Connection: Transfer-Encoding

With the FBI investigating a cyberattack that hit at least five banks, including JPMorgan Chase, many consumers are wondering what they can do to protect themselves if their accounts have been compromised.

Here are some steps to take:

Don't be taken Phishing

Banks and other financial institutions do not send emails asking customers to input their account information, verify account data or update their records.

Such emails are what are known as "phishing attacks" because the hackers are fishing for information they can use to enter a network and steal information.

Consumers who get one of these emails should immediately delete it. Don't click on any of the links.

Often the bank or financial institution will have information on its website about these types of fraud attempts. Open a new browser window and type in your bank's address and search on words like "fraud" or "scam" to see. When in doubt, call your bank.

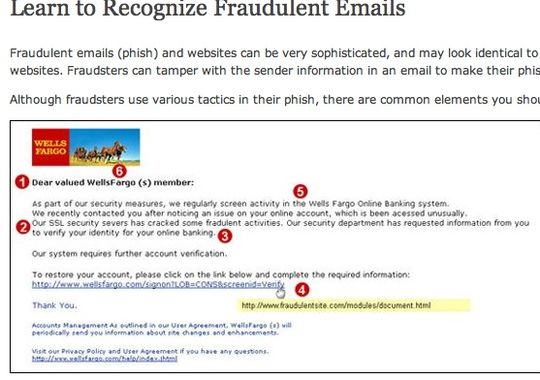

JPMorgan has a page[1] specifically addressing phishing. Here's the page[2] Wells Fargo has up:

The warning page Wells Fargo has posted about email fraud.(Photo: Wells Fargo)

Check your statements every month

Many consumers don't bother to go through their bank and credit card statements each month. But that's a crucial way to detect fraud early on. Look at each transaction to ensure that you, not a fraudster, made them it.

If something looks fishy, call your bank or credit card company to ask.

"The sooner we know what has happened, the sooner we can being to help you," as Chase[3] puts it on its website.

Beware stray phone calls

If someone calls purporting to be from your bank or financial institution, don't give any account information or other personal information over the phone, including your age, address, Social Security number or information about family members.

While banks and credit card companies will sometimes call when they detect fraud, they do not ask for information on those calls.

If someone does ask, get their name, title, location and phone number. Then, don't call that number back but rather call the bank's general number and ask them to put you through to that person.

No bank employee should become angry or frustrated if you want to be careful and confirm that it's a legitimate call, they will instead welcome it.

Scammers often try to intimidate their victims into giving information — don't fall for it.

Be aware

There are steps consumers can take to protect against online financial hackers and scammers.(Photo: Thinkstock)

The Internet is a wonderful, hugely useful addition to our lives. But it's also a great venue for scammers and fraudsters — often in other countries — to try to steal from you.

There are entire call centers and offices devoted to creating this type of fraud, it's organized, well-funded crime.

You wouldn't give a stranger who walked up to you on the street information about your financial accounts. Don't do it online.

Read or Share this story: http://usat.ly/1tOsYB5

References

- ^ https://www.jpmorgan.com/tss/General/Internet_Fraud_and_Identity_Theft/1123021915423 (www.jpmorgan.com)

- ^ https://www.wellsfargo.com/privacy-security/fraud/recognize-email-scams (www.wellsfargo.com)

- ^ https://www.chase.com/resources/report-fraud (www.chase.com)