World Wrestling gets Wall Street style take down

Holy Hulkamania. Wall Street is hammering World Wrestling Entertainment.

Shares of the sports entertainment company plunged $4.12 to $23.90 in heavyweight trading Monday - a dive only pro wrestler The Undertaker might appreciate.

Behind the 15% downdraft, a bounce back from an intraday 22% slide: Word that 667,000 fans had signed up for WWE Network, the $9.99 monthly subscription service launched Feb. 24.

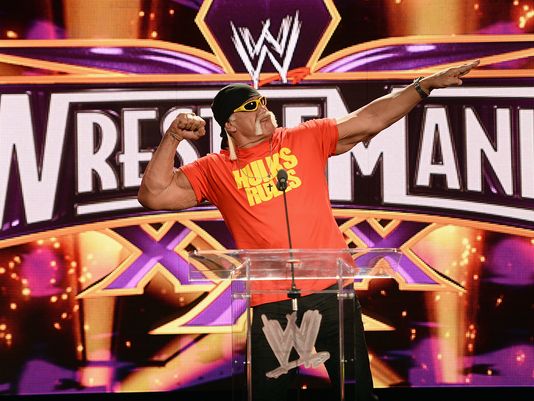

WWE says it's well on its way towards a year-end goal of 1 million subscribers. Still, some stockholders found the 42-day count underwhelming and unloaded shares a day after the company's signature event, WrestleMania 30, at which The Undertaker's 21-match winning streak ended before a packed Mercedes-Benz Superdome in New Orleans.

One of Wall Street's biggest Monday losers had been on a roll for much of the past year, surging from $8.56 to $31.98 by last month on prospects for WWE Network, the Internet streaming service which augments ending distribution agreements with several broadcast and cable TV networks. (WWE also has a new deal with Britain's BSKB network).

The faux sport, which turned Hulk Hogan, The Rock, John Cena and even WWE CEO Vince McMahon into very real cross-over film and entertainment stars, continues to have a wide following. According to company filings, 256 live North American events in 2013 attracted more than 1.5 million fans, another 382,000 at 56 events overseas.

WWE conceded in its annual statement that it lacks expertise in its subscription model and "could experience significant setbacks" monetizing the service. The company posted a fourth-quarter operating loss of $12.2 million, compared to income of $2.6 million in the year-ago quarter, due mostly to investments in WWE Network.

Among Wall Street stock analysts, at least two have sell ratings on WWE. Still, others remain on the buy side of the ring, seeing promise because WWE Network offers 24/7 content and includes offerings such as Wrestlemania and other marquis TV events that previously cost fans up to $59.95.

"The subscription numbers for the new WWE network are very solid and healthy,'' says Kim Opiatowski, an analyst for The Vertical Group. "The stock may have gotten a little ahead of itself, and a lot of momentum names have been fading. And people may have also taken money off the table."

Opiatowski, who has had a buy rating on the stock since mid-January, is maintaining a $33 price target.

Opiatowski, however, warns that 2014 could be as volatile as a hyped up ring battle.

"Results for 2014 could vary dramatically from our estimates depending upon the company's success and timing in signing up subscribers and resulting cannibalization of its pay per view base,'' she says. "Another area of concern is the cost of creating original content to air on the 24/7 WWE network and the balance between content costs and the addition of new subscribers."

Tweet Strauss @gbstrauss.