Rise in legal insider selling raises yellow flag

Corporate insiders are selling shares of their own stock at a quickened pace at the same time the U.S. stock market is making new highs, a bearish sign that raises a yellow caution flag for investors.

Neil Leeson, an ETF strategist at Ned Davis Research, zapped out a warning to clients today about “legal” insider trading.

“Despite the fact that most investors feel they have no alternative to being fully invested (in stocks), there is one crowd of investors who has turned into pretty consistent sellers, and that’s corporate insiders,” Leeson told clients in a video.

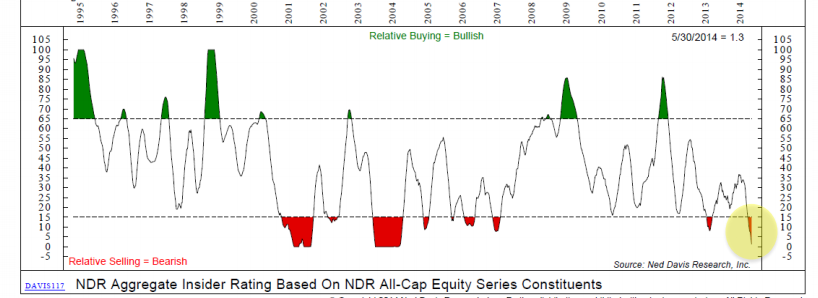

In fact, insider selling has picked up so much that is has generated a new “sell signal” on the market, Leeson said, citing an NDR indicator that tracks and measures insider buying and selling.

“Insider selling,” Leeson says, “is typically bearish for markets.”

When insiders are selling, it sends the message that they believe their company’s shares have become fully valued and, therefore, have limited upside.

In the chart below, which was included in the NDR report, you will see in the far right corner that insider selling is now swamping insider buying and has hit a “bearish” level.

Selling of stock by corporate insiders raises a yellow warning flag for the overall market, an analyst at Ned Davis Research says.

A look at ETFs shows high insider selling in the following three sectors: consumer staples, health care and transports, as well as stocks in the Dow Jones industrial average, according to NDR data.

Insider selling is abundant in the consumer staples sector, with more than 64% of the stocks in the SPDR Consumer Staples Select Sector ETF experiencing selling by corporate insiders, says NDR. Seven of the 10 largest stocks in the ETF have insiders selling.