Is 1987-type market crash 37 trading days away?

Investors marveling at the striking similarities of the bull market today to the one that ended in 1987 are hoping history doesn’t repeat itself.

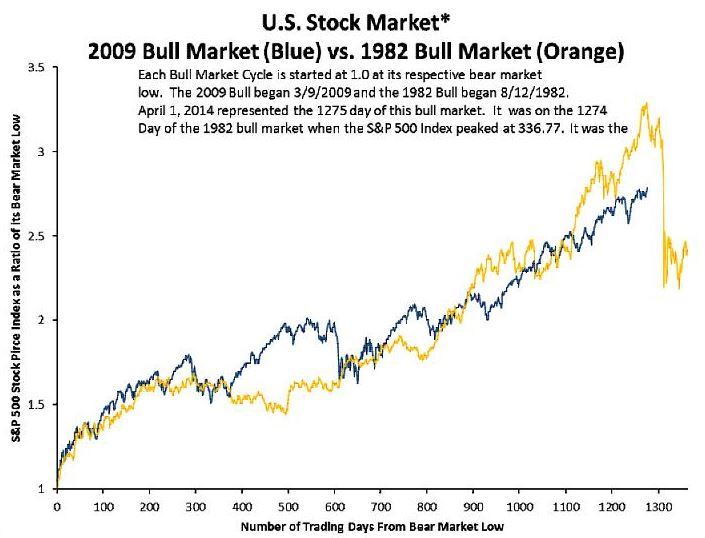

If it does, the market could be in some serious trouble in 37 trading days. In 37 trading days, the ongoing bull market would be 1,311 trading days old, says Jim Paulsen of Wells Capital Management. That is a scary date because it was on the 1,311 trading day after the start of the 1982 bull market that the Standard & Poor’s 500 suffered its biggest one-day crash in history on Oct. 19, 1987. That crash snuffed out what had been a powerful market rally starting in 1982.

Normally these kinds of things are just market oddities. But investors are taking this one seriously since there are such strong similarities with the 1982 bull market and the one the market is currently in. For instance, the current bull run has marked a 175% rally from the low, which is where the 1982 bull was at this point in its run, Paulsen says.

Investors won’t have to wait long to know if the 1987 market is a pattern. The current bull run hit its 1,274th trading day on March 31, 2014. The 1,274th trading day of the 1982 bull market was Aug. 25, 1987, which turned out to be a notable top, Paulsen says.

1987 had its own unique issues not present today. Prime rates were at 21% and the oil cartel had a grip on the economy, Paulsen says.

That’s not to say a crash is inevitable. Paulsen says that a 10% correction would be more likely than a full blown crash. And stocks might even rise first. And the market is famous for not following any patterns at all.

“Don’t worry much, however, about another major style 1987 collapse. History doesn’t usually fully repeat,” Paulsen wrote in his note to clients.