Do you own stock? You're getting a 23% raise

The soaring stock market isn’t the only good news for investors. Dividends are set to jump by a double-digit percentage from 2013′s already record level.

The bottom line is that investors can expect a nice raise, to the tune of 22.9% over the dividend payout increase in the same period a year ago, says Howard Silverblatt of S&P Dow Jones Indices. Net increases to dividends (dividend hikes minus dividend cuts) are $17.8 billion for U.S. stock, versus a $14.5 billion increase in the first quarter of 2013, Silverblatt says.

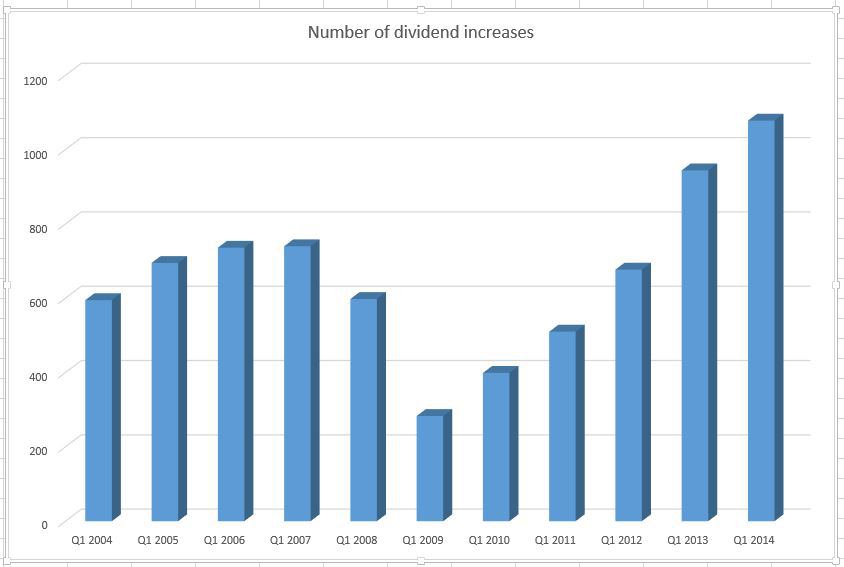

Flush with record profit and record piles of cash, companies are boosting dividends faster than even during the boom of the late 1970s. Nearly 1,078 dividend increases have been reported during the first quarter of 2014, the biggest quarter ever for increases. The number of dividend increases even tops the number of boosts in the first quarter of 1979, 1069, which has stood as a long-standing record.

All this means that for investors looking for income, or at least some extra money, dividends are a tough game to beat. The weighted-average dividend yield of the Standard & Poor’s 500 is now 2.48%, up from 2.44% at the end of the first quarter of 2013. That makes dividends one of the best sources of income going amid the perpetual low-interest rate world we live in. Dividend payments are expected to rise 15% in the first quarter of 2014 from the first quarter of 2013.

If there’s a risk to dividends, it’s the rise of initial public offerings of companies that don’t pay dividends. The percentage of companies paying dividends fell a bit to 47% in the first quarter from 47.7% in the fourth quarter.

But still, it’s an undeniable golden age for dividends and those who appreciate them. “Dividends have not only recovered from their bottom, but are setting new records,” Silverblatt says.