15 big companies face a darkening year

The sun sets over the Manhattan skyline August 14, 2003 during a major power outage affecting a large part of the north eastern United States and Canada.(Photo: Robert Giroux, Getty Images)

Here's a dismal and dark reality to 2016: It's not looking so hot.

There are 15 stocks in the Standard & Poor's 500, almost entirely energy companies like Devon Energy (DVN), Cabot Oil & Gas (COG) and ConocoPhillips (COP), where analysts have downgraded by 100% or more what they expect the companies to earn on an adjusted basis for calendar 2016, according to USA TODAY analysis of data from S&P Global Market Intelligence. These massive all cuts in estimates have been made just over the past month as analysts have processed fourth-quarter earnings reports from the two-thirds of S&P 500 that have reported.

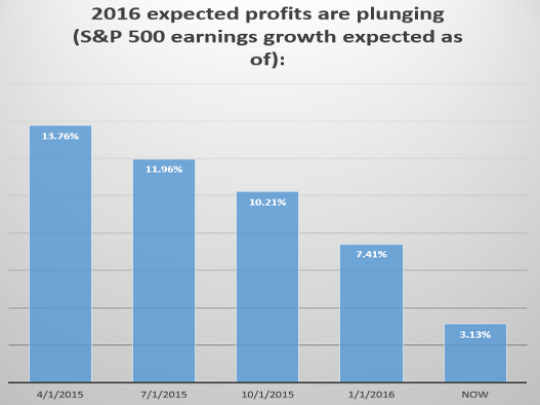

It's not just energy companies seeing profit forecasts for the year get cut - and fast. Analysts are now calling for Standard & Poor's 500 profits to rise just 3.1% this year, down dramatically from the 7.4% they expected at the start of the year and 10.2% they predicted on Oct. 1, 2015, says S&P Global Market Intelligence. This isn't just an energy problem. Earnings expectations for 2016 have been cut for 69% of the companies in the S&P 500. Analysts have taken down estimates by 20% on average for all the stocks in the S&P 500. Estimates are also being cut on a bevy of non-energy companies like burrito chain Chipotle Mexican Grill (CMG), biotech Vertex Pharmaceuticals (VRTX) and online retailer Amazon.com (AMZN).

2016 expected profits are plunging (Photo: S&P Global Market Intelligence via Microsoft Excel)

Viciously downgraded expectations for profit in 2016 is a big reason for the market's recent troubles. The Standard & Poor's 500 is now down 13% from its highest point over the past 12 months - putting it squarely in a correction. Investors are repricing the value of stocks given their rapidly falling expectations for profit.

Some of the most extreme examples really drive home the point of falling expectations. Energy companies - by far - account for the biggest and most vicious of the cuts making up 14 of the 15 biggest cuts. Devon Energy is the most dramatic example. A month ago, investors knew the Oklahoma City-based oil exploration firm's bottom line was going to be ugly and called for an adjusted loss per share of a nickel. Just a month later, though, analysts now are telling investors to brace for a brutal loss of $1.12 a share.

BIGGEST DOWNWARD REVISIONS OF S&P 500 COMPANIES' EXPECTED 2016 PROFIT *

Company, symbol, 2016 revision, YTD % Ch. stock

Devon Energy, DVN, -2,107.6%, -26.0%

Cabot Oil & Gas, COG, -1,274.6%, 18.3%

ConocoPhillips, COP, -1,236.3%, -26.3%

Cimarex Energy, XEC, -909.3%, -4.4%

EOG Resources, EOG, -729.6%, -3.3%

Baker Hughes, BHI, -722.9%, -7.2%

Pioneer Natural Resources, PXD, -357.4%, -8.1%

CONSOL Energy, CNX, -207.8%, 8.2%

Newfield Exploration, NFX, -184.2%, -21.8%

Helmerich & Payne, HP, -179.7%, -7.3%

Occidental Petroleum, OXY, -152.3%, -2.1%

Noble Energy, NBL, -133.8%, -13.9%

Southwestern Energy, SWN, -130.9%, 31.4%

Freeport-McMoRan, FCX, -104.9%, -22.2%

National Oilwell Varco, NOV, -102.5%, -15.2%

* Based on adjusted 2016 estimates

Sources: S&P Global Market Intelligence, USA TODAY

Investors can deal with the fact 2016 isn't looking so hot for energy companies - since oil prices are in freefall. But what might be more surprising are some of the major profit downgrades for some companies in hot areas. Amazon.com, for instance, has been infamously grabbing market share from big-box retailers and department stores. But analysts just over the past month have cut their 2016 profit forecast for the company by 13% to $4.68 a share.

Vertex Pharmaceuticals, a biotech working on a number of treatments including those for cystic fibrosis, has gone from a darling stock to one where analysts are tamping down expectations. Shares of the company have lost more than a third of their value this year - as analysts cut their 2016 adjusted profit forecasts by a third to $2.27 a share. Chipotle Mexican Grill, still struggling to shake off a rash of food safety issues, has also seen 2016 expected profit forecasts for the year drop by 42%.

Maybe analysts are getting too antsy and are too quick to take a knife to expectations. But companies haven't exactly given investors much reason to be hopeful - and the stock market is pricing in this new outlook.

BIGGEST DOWNWARD REVISIONS OF S&P 500 COMPANIES' EXPECTED 2016 PROFIT (excluding energy and materials)*

Company, symbol, 2016 revision, YTD % Ch. stock

Chipotle Mexican Grill, CMG, -41.9%, -7.3%

Vertex Pharmaceuticals, VRTX, -32.8%, -34.8%

Legg Mason, LM, -19.8%, -32.5%

Ralph Lauren, RL, -18.9%, -23.5%

SanDisk, SNDK, -18.8%, -10.7%

Level 3, LVLT, -16.7%, -21.4%

Archer-Daniels-Midland, ADM, -16.1%, -9.2%

Flowserve, FLS, -15.5%, -4%

Plum Creek Timber, PCL, -14.3%, -21.3%

Mondelez, MDLZ, -14.2%, -19%

Western Digital, WDC, -13%, -30.2%

Amazon.com, AMZN, -13%, -27.8%

Analog Devices, ADI, -12.1%, -11.1%

Seagate Technology, STX, -11.3%, 17.2%

Tiffany, TIF, -11%, -17.5%

* Based on adjusted 2016 estimates

Sources: S&P Global Market Intelligence, USA TODAY

Read or Share this story: http://usat.ly/1Tah4R3