The secrets of the world's most valuable brands

This year’s BrandZ list of the 100 most valuable global brands sees Google knock the crown off long time holder Apple, Ford make a comeback after a six-year absence and combined value hit nearly $3trn.

Click here to view the full list of the 100 most valuable brands. [1]

The economic recovery, rising consumer confidence and sophisticated marketing techniques have helped to push up the combined value of the top 100 most valuable global brands to nearly $3trn (£1.8trn), according to this year’s BrandZ list compiled by Millward Brown. As brand values continue to rise, established players are cementing their market dominance and making it difficult for smaller brands to break through.

Google[2] ’s value rise is one of the biggest – up 40 per cent this year to a breathtaking $158.8bn, overtaking Apple[3] from second place to claim the top spot for the first time since 2010. Apple is valued at $147.9bn, down 20 per cent from last year and Amazon ($64.3bn) has risen to 10th place at the expense of China Mobile ($49.9bn). There are only seven new brands in the top 100 this year, the lowest number of new entrants since the ranking began in 2006.

This includes the debut of two giant tech brands: Twitter[4] comes in at number 71 with a value of $13.8bn while LinkedIn enters at 78 ($12.4bn).

The brands that are most successful are gaining ‘share of life’ - they are making themselves essential to people in new ways

“Brands are getting better, stronger and more focused on their consumers, so it’s becoming tougher to get into the ranking,” says global BrandZ director Peter Walshe. “The bar is continuing to rise. Brands need to connect with consumers in meaningful and different ways to be successful.”

Millward Brown Optimor creates the BrandZ list by taking the financial value generated by a brand and multiplying it against a brand contribution measure. This measure is based on interviews with more than 170,000 consumers across 30 countries. The findings, which cover over 10,000 brands, are used to determine the extent to which a brand’s profits are generated by its ability to create loyalty (see methodology below[5]).

There is a correlation between movements in brand value and the global economic climate. The combined value of the top 100 has grown by 12 per cent to $2.9trn this year, building on 7 per cent growth last year and a 0.4 per cent increase in 2012.

Brand value is also growing at a quicker rate than stock market values, with the BrandZ top 100 enjoying a compound annual growth rate of 8.9 per cent since 2006 compared to 4.6 per cent for the Standard & Poor’s 500 stock market index.

“Brand value went down at the peak of the recession but it didn’t go down as far as the stock market benchmark,” explains Walshe.

“It has recovered much more quickly and the gap is continuing to widen. That demonstrates the sustainability of strong brands and the fact that they are so important to our lives.”

‘Share of life’

Google has ensured it has many stakes in people’s lives by developing its Android operating system and acquiring brands such as Nest Labs

Google takes the top spot this year thanks to the huge expansion of its products and services. The company’s investment in its growth strategy had a detrimental effect on its earning power in recent years and hence its brand value but the strategy is now paying dividends as Google’s technology launches and acquisitions enable it to play a prominent role in different areas of people’s lives.

“The brands that are most successful are gaining ‘share of life’ – they are making themselves essential to people in new ways,” says Walshe. “Whether it’s Google with Google Wallet or Facebook with its new money-transfer system, these brands are thinking about the consumer and how they can make their lives better.”

Google has ensured it has many stakes in people’s lives by developing its Android operating system as a rival to Apple’s iOS and acquiring brands such as Nest Labs to develop digitally connected appliances for the home. This has coincided with a quiet year for Apple in terms of new products, which has contributed to its brand value falling 20 per cent.

However, the iPhone maker remains one of only three brands to have a value in excess of $100bn.

Microsoft[6] has risen to fourth place with a brand value of $90.2bn, an increase of 29 per cent on last year. The company has increased its relevance to consumers by strengthening its position in the mobile market with its Windows Phone platform. Excitement is also building around the brand after the return of Bill Gates to an executive role.

Other fast risers include Facebook[7] , at 21, whose value surged 68 per cent to $35.7bn; and BT , which rose by 61 per cent to $15.4bn and is at 64. BT has successfully increased its ‘share of life’ by incorporating sports broadcasting into its services. It revealed this month that BT Sport has helped its consumer division post its first yearly revenue growth in more than a decade.

Google director of consumer marketing Graham Bednash agrees that focusing on relevance and the role that the brand plays in people’s lives is vital. This approach has helped Google regain the title of the world’s most valuable brand, he suggests.

“Our sole goal is to create products and tools that make people’s lives easier – where technology gets out of the way and people have more time to do the things they love,” he says. “That’s why it’s terrific that our users appreciate this, and we’re delighted to be top of the BrandZ rankings again.”

More valued

Ikea is the fourth fastest riser in the top 100, with its brand value up 61 per cent on 2013

Only 18 brands lost value this year, compared to an average of 31 each year since 2006 and 44 at the peak of the recession in 2009. The ranking shows that brands across all price points have grown in value, with the fast food category rising by 10 per cent and the luxury goods sector by 16 per cent.

The research uses three key metrics to work out the power of a brand. This involves looking at whether a brand is meaningful, different and salient. According to BrandZ, brand power within the top 100 has grown considerably in recent years, from an index score of 165 in 2008 (where an average brand is 100) to a score of 211 this year.

Walshe suggests that the size of a brand can help to maintain its dominance. McDonald’s[8] and Coca-Cola[9] remain in the top 10 despite seeing their brand value growth slow or decline this year. McDonald’s is fifth, with a brand value of $85.7bn, down 5 per cent on last year, while Coca-Cola is sixth with a brand value of $80.7bn, up 3 per cent.

Visa ranks seventh after its brand value jumped 41 per cent this year to $79.2bn – more valuable than MasterCard and American Express combined.

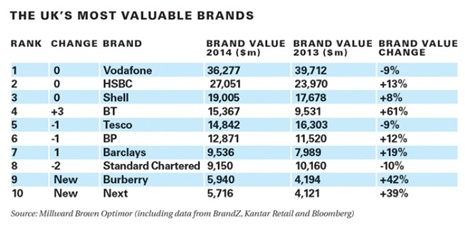

Source: Millward Brown Optimor (including data from BrandZ, Kantar Retail and Bloomberg)

The dominance of the biggest companies makes it difficult for brands from emerging economies to break into the top 100. Five of the seven new entrants are American brands, although the fastest growing brand across the ranking is Chinese web portal Tencent, which has grown in value by 97 per cent year-on-year to $53.6bn, moving it to 14th place.

In total there are 14 brands from emerging economies, which account for 11 per cent of the total value. There are six UK brands in the top 100, with Vodafone[10] the most valuable at $36.3bn.

Source: Millward Brown Optimor

Walshe believes that price is having less of an effect on consumers’ decision making and that as the economy improves, people are more swayed by branding and marketing. This means that the biggest companies continue to dominate as they reinvest their profits on their own brands.

“The use of new media is playing a big part in a lot of brands’ success this year,” he says. “Marketers are getting better at using tools such as social media to engage people in relevant ways and that is reflected by the ranking.”

A good example is Ikea, which is the fourth fastest riser in the top 100 with a brand value of $19.4bn, up 61 per cent on 2013. In addition to expanding its core products and services, such as a new ‘bespoke’ kitchen range, the furniture retailer is experimenting with different forms of technology to enhance the customer experience.

This includes integrating augmented reality (AR) technology into its latest Ikea Catalogue mobile app to enable consumers to see how furniture would look in their homes. UK marketing manager Peter Wright has said that AR is one of the most exciting forms of consumer-facing technology available to the business.

Tech invasion

Value is high among technology brands, which account for just under a fifth of the top 100 brands but nearly a third of the total value (18 brands with a combined worth of $827bn). This compares to the financial sector, where 27 brands make it into the top 100 at a total value of $584bn.

Three of the new entrants in this year’s list are technology brands: Twitter at 71 ($13.8bn), LinkedIn at 78 ($12.4bn) and PayPal at 97 ($9.8bn). All these companies have taken advantage of the rapid growth of social media and smartphone usage over the past year to establish their brands as leading players in their markets.

PayPal, for example, is attempting to lead the way with mobile payment technology. This includes the launch of its ‘check in’ function last year whereby people using the PayPal app on their smartphones can identify shops in their vicinity that accept PayPal payment, click on them to check in and pay using their PayPal profile.

Twitter’s entrance into the BrandZ top 100 coincides with its first year as a publicly listed company. While Twitter’s IPO was a huge success that saw it raise $1.8bn, doubts are beginning to emerge about the company’s ability to continue growing its user base.

LinkedIn, which completed an IPO in 2011, has sought to grow its membership by launching new products for its audience of professional networkers. It passed 300 million members worldwide this year, including 15 million in the UK, and the company claims it is growing at a rate of two new members per second.

LinkedIn EMEA director of consumer marketing Peter Maxmin says: “LinkedIn has always had a focus on the professional market, and it’s this consistency that helps members understand the value the brand can offer in their job and career.”

Recent additions to its service include opening up its publishing platform to a select group of users to allow them to publish their own content and grow their influence on the site. Maxmin believes LinkedIn can continue to build on its strong showing in this year’s list through more innovation and product launches.

“We have just scratched the surface when it comes to the value we can offer professionals,” he says. “We will continue to invest in new products and technologies for our members as their jobs and careers evolve.”

Strengthen the core brand

Starbucks refocused on its core purpose and has risen 13 places to 31 in this year’s top 100 list

While some brands have grown their value by developing new services, others have enjoyed success by refocusing on their core purpose. Starbucks, which has risen 13 places to 31 with a brand value of $25.8bn, “has effectively gone back to being different by focusing on what made it successful in the first place – defining the ‘third place’ for consumers between work and home,” says Walshe at BrandZ.

Ian Cranna, vice-president of marketing and category at Starbucks[11] EMEA, confirms that the company’s investment in its coffee shops and the experience it offers consumers has been a key factor in helping it grow its brand value (see Q&A below[12]). “Every day special connections are made between customers and their favourite baristas,” he claims. “Collectively, our innovation and commitment to our partners and the communities where we do business all contribute to the relationship our customers have with the brand.”

The company has remained committed to pursuing its own charity work and community projects in the UK, including the Starbucks Youth Action initiative. Cranna believes that this approach has also helped to boost the value of the brand. “We continue to act in our belief that we should use our scale for good,” he says. “Community service is a year-round commitment.”

The improving economic climate appears to have helped consumers to ‘rediscover’ certain brands too. Ford returns to the top 100 for the first time since 2008, entering at 84 with a brand value of $11.8bn. The company’s absence from the ranking coincided with the economic downturn and a deep depression in the American car market, which saw Ford’s two biggest rivals, Chrysler and General Motors, receive bailouts from the US government.

Ford’s return to the top 100 is reward for a long and painful restructuring process that saw the company close manufacturing plants around the world

Ford opted to avoid this in favour of restructuring its own balance sheet and refocusing its operations around a strict recovery plan (see case study below[13]). The One Ford plan, brought in by chief executive Alan Mulally, involved disposing of brands and assets that were not central to its business while investing in rigorous product development around the world.

Ford’s UK marketing director Anthony Ireson notes that while his predecessors used to launch cars at a rate of one or two a year, he is launching new models at a rate of one every six weeks.

“With One Ford we have got rid of brands that were taking attention away from fixing the Ford brand, we are reconfiguring our production to match demand and we are creating demand by launching exciting new technological products,” he says.

“There’s nothing in the One Ford model that you wouldn’t read in the first chapter of a business book, but actually doing it in a huge, global, multicultural company is challenging. The fact that we are doing it is why we are back in the BrandZ list.”

Case Study: Ford (Brand value: $11.8bn. New entry at 84)

Ford is the best example of a comeback brand in this year’s BrandZ top 100. It returns to the list for the first time in six years after slipping out of the ranking during the recession and the slump in the American car market. The brand’s return to the top 100 is reward for a long and painful restructuring process that saw Ford close manufacturing plants around the world and reconfigure its approach to product development.

This recovery strategy has included focusing resources on innovation and new technologies such as its super-efficient 1.0-litre EcoBoost engine, which now accounts for about a third of Focus model sales. Ford has also sought to lead the way on in-car technology by developing Sync, a communications and entertainment system produced in partnership with Microsoft.

UK marketing director Anthony Ireson notes that Ford is now showing greater agility in the global market by launching cars to match the demand in different nations. Previously, Ford was hindered by the complexity of its production systems but a new approach has allowed the company to bring other global models to Europe for the first time. This includes the iconic Mustang, which is launching as a right-hand drive in the UK next year.

“Our mantra now is to build cars where we can build them at the best quality and value and sell them where we can sell them,” explains Ireson.

Q&A: Ian Cranna

Vice-president of marketing and category

Starbucks EMEA

(Brand value of $25.8bn. Rank 31, up 13 places)

Marketing Week (MW): What factors have helped Starbucks increase its value this year?

Ian Cranna (IC): Several initiatives have elevated the Starbucks brand. We continued our commitment to buying and serving high-quality coffee that is responsibly grown and ethically traded with the addition of a new global agronomy centre in Costa Rica. We also invested in our emerging brands to create a pipeline of breakthrough products and experiences: for example, the launch of La Boulange’s warm bakery offerings in the US. And we opened nearly 2,000 new stores across the globe, including our first stores in India, Vietnam and Monaco and announcing plans to enter Colombia in 2014.

MW: What marketing activations have given the brand a boost in the past year?

IC: We’ve earned substantial recognition for our continued leadership and innovation in mobile, digital and loyalty initiatives, and have been acclaimed for having the world’s most innovative and successful retail mobile payment, pre-paid card and loyalty programmes. More than 10 million Starbucks customers use the Starbucks Mobile Payment App, while 2013 was another record year for the pre-paid Starbucks Card programme.

MW: What do you plan to do to continue building brand value?

IC: Ultimately it’s about our customers and the communities we serve. We’re fortunate to be a brand that people feel genuinely connected to no matter where, when or how they find us. We’re committed to creating consistent and authentic ongoing engagement.

Methodology

Millward Brown Optimor creates the BrandZ Top 100 Most Valuable Global Brands ranking by taking the financial value generated by a brand ($) and multiplying it against a brand contribution measure (%).

This measure is based on interviews with 170,000 consumers each year across 30 countries. The survey covers more than 10,000 brands in all categories except airlines and media brands. Consumers are asked about the extent to which the brands fulfil three criteria: different, meaningful and salient.

The data provides the brand contribution measure, which is used to determine the extent to which a brand’s profits are generated by its ability to create loyalty.

References

- ^ Click here to view the full list of the 100 most valuable brands. (www.marketingweek.co.uk)

- ^ Google (www.marketingweek.co.uk)

- ^ Apple (www.marketingweek.co.uk)

- ^ Twitter (www.marketingweek.co.uk)

- ^ see methodology below (www.marketingweek.co.uk)

- ^ Microsoft (www.marketingweek.co.uk)

- ^ Facebook (www.marketingweek.co.uk)

- ^ McDonald’s (www.marketingweek.co.uk)

- ^ Coca-Cola (www.marketingweek.co.uk)

- ^ Vodafone (www.marketingweek.co.uk)

- ^ Starbucks (www.marketingweek.co.uk)

- ^ see Q&A below (www.marketingweek.co.uk)

- ^ see case study below (www.marketingweek.co.uk)