The great budget squeeze

Despite concerns over marketing budgets, new research shows marketers are optimistic about 2013. Are their expectations viable?

Marketers believe they will have to do more with less money in 2013, according to new research seen by Marketing Week. Although marketers are relatively confident about their job security and career prospects over the next 12 months, they fear a poor UK economy and further pressure on marketing budgets.

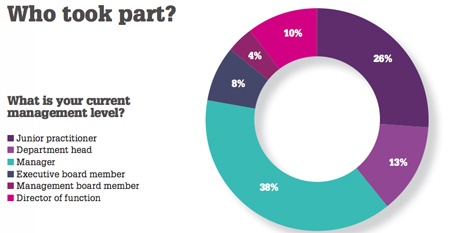

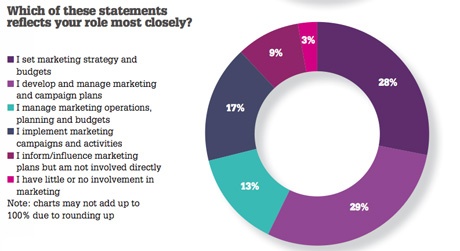

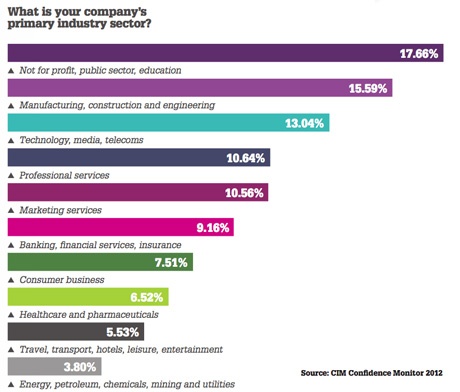

The inaugural marketing confidence monitor from the Chartered Institute of Marketing (CIM), which was supported by Deloitte and Forbes and surveyed more than 1,200 UK marketers, reveals that almost half feel more confident about career prospects over the next 12 months than in the past year and 60 per cent see a low risk to their job security over the same period.

Marketers are also confident about organisational growth. More than 40 per cent expect their organisation to embrace more risk and ambition over the next 12 months and half anticipate their organisation’s financial and growth targets will increase in their next fiscal period.

But while company targets may be increasing, marketers will not have more resources to help turn aims into reality. A worrying 60 per cent of those marketers expecting increased company targets in the year ahead report that their marketing budgets will either remain static or be cut. The organisations least confident of having the right level of marketing investment are those that rely on discretionary consumer spending, such as travel, entertainment, banking and finance.

CIM head of insights Thomas Brown explains: “The picture is that confidence seems to be getting better but it’s weighed down by concerns over budgets, growth and performance in the UK. Companies are hungry for growth, with reports of increased risk, ambition and targets expected to increase, but actually the marketing investment that follows seems to be lagging.

“Are marketers expected to do more with the same or less in the next 12 months? If organisations want the numbers to point upwards and to grow in the next year but are not investing to fuel that, what will be the consequence over the course of the year?”

Misa von Tunzelman, director of marketing, communications and research at global property firm Jones Lang LaSalle, says she understands the reluctance of firms to raise marketing budgets indiscriminately to help meet targets. “If you want to increase profitability, you need to grow revenues faster than you grow cost - which isn’t to say you don’t increase marketing budget,” she argues. “But you need to invest sensibly rather than just increasing marketing spend at the same rate you increase revenue targets.

“If there’s one thing the recession has taught us, it’s looking at ways to make the spend work harder, rather than making the people work harder. It’s about being more innovative. If you just go for the route of working people harder, you reduce innovation because you don’t give people time to be creative.”

Guardian News and Media director of brand and engagement Richard Furness agrees. He says that good team structure, creativity and talented marketers are more important than budget. “Budget, and the lack of it, is a notion bad marketers hide behind,” he warns.

With so much focus on spending, marketers have to justify their choices. Almost 70 per cent of marketers responding to the CIM research say their organisation has become more measurement-focused over the past 12 months. Just 4 per cent report a drop in focus on measurement over the period.

The CIM expected to see those marketers who anticipate reduced marketing budgets reporting an increased focus on measurement and return on investment. But the research shows the opposite trend.

Von Tunzelman agrees there is no natural link between strong measurement of brand activity and expected marketing budget cuts, saying: “I don’t see it having that direct correlation.”

She says marketers should worry more about finding the right metrics to use for their own brand. “Measurement is about making sure you have the right level of investment. Sometimes that means more investment or less - often it means reallocation of funds. If you have effective measurement, you can give decent advice to your business leaders on where they should invest.”

Crossed purposes

The CIM’s Brown says that marketers can take heart from the findings that more scrutiny and measurement does not inevitably lead to budget cuts. He says: “There is this idea that finance pokes into marketing and tries to whittle marketing down to a formula. The positive thing here is that those at organisations where they have been subject to more scrutiny are not seeing the immediate consequence of having their budgets cut.”

However, Brown warns that marketers should invest in forming better relationships with the finance department. He says that understanding where organisations are investing and moving resources is a business issue that concerns more than simply the marketing department.

“We hear many positive stories where marketing directors are pre-empting the fact that their budget may be questioned,” says Brown. “They want to make sure that they are able to align with the growth ambitions of an organisation so they work hand-in-hand with finance. Finance is not the dark side or the enemy, as perhaps it has been painted historically. It is phenomenally helpful in laying the focus on what is happening with our marketing pounds and how we make the best use of that.”

Not all marketers are convinced that measuring and gathering vast amounts of data is always the right move. Nick Eades, chief marketing officer at tech firm Psion, argues: “I think we are in grave danger of over-measuring. Just because there is a lot of data, doesn’t necessarily mean there is a lot of information. If it’s just measurement for measurement’s sake, then you just need to stop.

“When threatened, marketers often resort to displays of data, peacock-style, and often show it to people who don’t give a monkey’s. That display of data doesn’t help us. You have to deliver a small number of actionable insights to the rest of the executive team and not baffle, blind and confuse them with tons of metrics.”

Eades claims that marketers need to get better at valuing the information that is available to them and acting on it, rather than endlessly gathering more data. He says that this will make marketing teams more efficient, which has to be their ultimate goal when budgets are under so much pressure.

Staying steady

With so much financial scrutiny for marketers expected in 2013, the CIM study also shows few departments will be beefing up their staff numbers. Just 23 per cent of UK marketers anticipate an increase in marketing headcount over the next year, compared with 17 per cent who see a reduction in staff and over half who see no change.

For existing marketers, however, there is a positive story about organisations committing to building marketing capability. Less than 8 per cent of employers were unwilling to invest in marketing skills development over the next 12 months.

More than a third of marketers also say their employers have already committed to their development in the year ahead, with a further 48 per cent reporting that opportunities will be available subject to business conditions.

Jones Lang LaSalle staff can take part in an organised career and development programme every year. Von Tunzelman says that regardless of market conditions, investment in this training programme is constant. She says in professional services marketing, there is a “clearly defined career development structure” and training programmes form a vital part.

The CIM research shows Jones Lang LaSalle is not alone in training investment. Many employers are retaining and training marketers rather than bringing in new staff. Brown says: “If you look back over the past few years, many organisations have been making cuts, they have changed structures and salaries have been frozen. We are reaching that point where there isn’t that much more fat to trim.

“If organisations have got a leaner marketing function today, they do have to start fuelling growth. So they have to make sure, in the changing environment of social media, digital and channels fragmenting, that they are equipping the people that they have with the skills and development opportunities that they need to do the job and meet the kind of goals that are being set.”

Guardian News and Media’s Furness, though, says that merely training internal candidates is not enough to meet every new challenge. “It is crucial to get the balance between developing the great potential you have internally, while ensuring you get the ‘fresh’ perspective that recruiting externally can offer,” he says.

Career break

The lack of companies recruiting externally may have a long-term effect on marketers’ careers. Although it has been common for marketers to move positions every two years, they may now find that staying for longer periods is more beneficial.

“That is a change of mindset for marketers,” says Eades at Psion. “People have got to work harder and not just harder but smarter. Marketers need to think about what skills are going to be important two years from now and it’s mostly around digital and social. We are playing a longer game now, people need to hunker down. If you are in a role, you have to grow to be bigger than the role; you need to sign up to training and be demanding of the training that’s in your plan.”

Although it is clear that training is a big issue for marketers, the research does not show a clear picture of overall UK economic growth. The CIM report shows a fairly even split between negative and positive views. Almost 40 per cent of marketers express falling confidence in growth and performance, 30 per cent are as confident as last year and the same amount report an increased optimism.

When looking back over the past 12 months, around 50 per cent of marketers believe that the economic conditions have worsened but less than 30 per cent believe their business to be influenced significantly by prevailing economic conditions. Forty per cent recognise economic uncertainty but are not adjusting their marketing plans.

The CIM’s Brown says: “All of this data is based on people that live and work in the UK in marketing roles. This is now a protracted period of economic turbulence and I didn’t expect lots of marketers saying ‘the organisation is massively changing its targets’ or that ‘it’s hooking everything on what the economy is doing’ because this has become a long-term downturn, as opposed to a dip or double-dip recession.”

The CIM study does not show any major uplift in economic confidence from marketers for the next 12 months, with the overall index just hitting the positive mark (see marketing confidence index scores below).

Von Tunzelman says: “The study reflects where you would expect to be with the current economic situation. If you look at other professions, you would probably get a similar view. What is interesting is how we as a profession then choose to react to this. We can do a lot to make sure we keep moving forward and how we can contribute success to our businesses.”

Brown also believes this is a good indicator of UK marketers’ awareness. “We are not seeing dramatic levels of confidence,” he says. “To me, this says that great marketers, both as individual consumers and practitioners, are in touch with what is going on around us.

It’s also good to see the beginnings of some positive sentiment.”

Methodology

The Chartered Institute of Marketing (CIM) confidence monitor tracks marketing sentiment and establishes industry-weighted scores on a range of -100 to +100 across four key areas, in order to develop an overall index score for the quarter.

- Confidence in career prospects over the next 12 months scored +19.76

- Confidence in marketing investment in the year ahead scored -6.81

- Confidence in meeting financial and growth targets scored +6.97

- Confidence in UK economic performance scored -3.42

These four dimensions produced a marketing confidence index of +4.12 for October 2012.

Thomas Brown, head of insights at the CIM, says: “Our inaugural marketing confidence monitor paints a mixed picture of confidence in the 12 months ahead, one which suggests a period of slow progress in the face of adversity.

“On the positive side, UK marketers report improving sentiment towards their career prospects, job security and development opportunities, as well as a slight improvement in confidence towards their organisation meeting financial and growth targets in the year ahead. On the less positive side, confidence in having access to the right level of marketing investment, both spend and headcount, in the year ahead falls into negative territory, as does the UK marketers’ outlook for UK economic performance.”