Taking back control: the personal data economy

Research seen exclusively by Marketing Week reveals the opportunities and threats to brands of the personal data economy, where new services are empowering consumers to take control of their own data.

‘Are there some marketers you trust but others you’d rather turn away?’ asks Ghostery, a service that lets people see and block the brands and companies that are tracking them online. Ghostery might not yet be a household name but it is a new brand in a burgeoning industry that is disrupting ‘big data’ by giving the power back to consumers and letting them manage their own information (see ‘Five emerging players in the new information business[1]’, below).

“A lot of organisations still think that the databases they have on customers belongs to them,” says Julian Saunders, chief executive of personal data store Allfiled, who says that consumers will be able to access their own data from a number of different sources.

“Companies haven’t fully realised the fact that those individuals have free choice and can go to any company they like and that there is very little value in owning a personal database.”

This new ‘personal information economy’ includes other emerging brands and services such as search engines that don’t collect browsing histories, portals that can tell people where and how their data has been breached and businesses that let people collect their data to monitor it in one place.

So rather than businesses making money by using and selling data on how people behave online – an activity that Boston Consulting Group says could be worth $1trn by 2020 in Europe – this new industry gives people their information back.

Some brands are already getting involved (see ‘How brands can be part of the personal information economy[2]’, below). Barclays, for example, has launched Cloud It, an online service that enables customers to upload and tag documents such as utility bills, bank statements and a digital copy of their passport, so that they can search for information easily. Users can also set up alerts such as a reminder for when their car insurance needs to be renewed.

Putting the power back in the hands of consumers will develop a trust with brands that makes for a more productive relationship

Consumer website MoneySavingExpert.com has launched Cheap Energy Club using technology from Allfiled, where consumers can monitor their gas and electricity tariff and easily compare it with other providers. This has been further boosted the Government’s efforts to increase competition across the energy sector with a move to make QR codes compulsory on every bill so that people’s energy consumption data can be uploaded to price comparison sites.

Start-up industry

However, a study by consultancy Ctrl-Shift suggests that it is smaller companies that are the early entrants to the personal information industry, indicating there has been one new start-up launching each week over the past year.

Ctrl-Shift says that about a third of these businesses are information storage services, a third are concerned with helping people manage whether they can be identified by brands, and the remainder are in ‘personal analytics’, which help people track their fitness activity such as running, or monitor how their mobile phone usage might be changing.

“Individuals are already managing and sharing lots of data online in the form of passwords, forms, profiles and so on,” says Alan Mitchell, strategy director at Ctrl-Shift and former Marketing Week columnist as well as government data adviser. “Personal data management services that help them do this better and more safely, and do more with their data, therefore have the potential to become ubiquitous.”

Having this type of relationship with people will ultimately be good for business. “Brands working with these services have the opportunity to build customer trust, prevent customers ‘going dark’ on them, access additional volunteered data and use this data to provide new services,” says Mitchell, who is running a conference on the personal information economy on 20 March.

Access to personal data

Nigel Shadbolt of the Open Data Institute (ODI), an organisation that he founded with Tim Berners-Lee, who invented the World Wide Web, believes that “the most effective personal information services understand that there is a much richer dialogue if you enter into a conversation with your consumer and your business, where there is a flow of information and data back and forth” (see Viewpoint, below[3]).

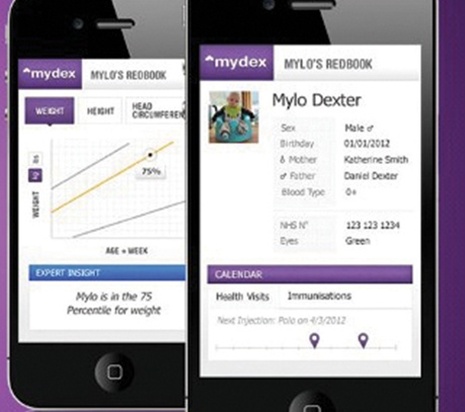

Personal data store Mydex is a member of the ODI, and is one of the Government’s nominated ‘identity assurance’ providers. People can sign up for free to store their address, employment and credit card details privately, and organisations can automatically populate the data store with details if consumers allow them to. Businesses pay a ‘connection fee’ to access the data and there are six companies going through that process.

Meanwhile, Midata, which was launched in 2011 by the Department for Business, Innovation and Skills, works by giving consumers better access to the electronic personal data that companies hold about them, with the aim of giving consumers greater control.

In July 2013, the Midata Innovation Lab was launched with backing from the Government, to get companies in the energy, telecoms, bank and credit card sectors involved in innovations to share data with consumers, organisations such as The BBC, Telefonica, Aviva and Npower joined the initiative.

But what kind of uptake can these services expect from people? Colin Strong, managing director of business and technology at market research company GfK, says: “This is still considered to be a minority activity; brands have not fully grasped the extent to which this is an opportunity for them – but it is also a threat if they do not engage in this.”

Consumer needs

Research by GfK seen exclusively by Marketing Week validates this point. The flow of information depends on the ‘value exchange’: consumers would supply more information to companies that provide better services or save them money. The study shows that 28 per cent strongly agree that they would provide companies with more information if it helped them to save money and 43 per cent agree somewhat.

In addition, 13 per cent strongly agree that they would provide companies with more information if they received a better service as a result and 41 per cent agree somewhat.

But Steve Edwards, executive director at agency Manning Gottlieb OMD suggests that people will not engage with the label ‘personal data services’.

“Personal data services will evolve and become part of our daily lives. They might not be called ‘personal data services’ and use terms like ‘control over data’, but they will emphasise the simplification of life,” says Edwards.

Although the industry seems to be growing, it has the potential to gather momentum if businesses are forced by law to give back data to people. Minister for consumer affairs and equalities Jo Swinson spoke to Marketing Week last year about why brands should not be reluctant to release data to consumers and about the threat of regulation should they fail to do so.

Last summer, information commissioner Christopher Graham warned that people are waking up to the value of their personal data, and that companies which fail to handle people’s information properly will lose their trust and even their business.

A matter of trust

Although the new personal information economy is an exciting industry, brands that get involved must be trustworthy. Graham cites the NHS’s care.data programme, a scheme that pools patients’ information and enables researchers to access anonymous medical records, which has been put on hold because the benefits had not been communicated sufficiently to the public.

Meanwhile, brands such as Barclays, Tesco and crowd-funding site Kickstarter all made headlines after suffering data breaches. Statistics released by the Global Research Business Network highlights a lack of trust across all types of organisations when it comes to data.

David Alexander, chief executive at Mydex, says: “I believe privacy is everybody’s right but we will never move forward if we make that the central argument. The central argument is about improved efficiency, improved consent and collaboration and clarity of purpose – knowing what happens when I tick a box and when I share data.”

He adds: “Privacy is one of those emotional subjects, it has woken people up to having a more secure way of managing their data and transacting. You cannot avoid the conversation but I do think you need a balanced argument.”

It is this balance that will effect whether data services take off, says Archna Luthra, clubs manager at MoneySavingExpert.com.

“Privacy and security is rightly a consideration. If people do not trust the service they are getting or what is happening with their data, then businesses will falter when it comes to getting these services off the ground. If you put too much emphasis on it, it might scare people away, even the early adopters. It is a fine balance but a valid consideration.”

Better targeting

Personal data is not always the issue when brands and services are looking to create better offerings. Westfield shopping centres work with nFluence, a company that creates user-generated profiles to transform how advertising targeting works, driven by information volunteered by consumers.

Privacy is everybody’s right but we will never move forward if it becomes the central argument – that is about improved efficiency, consent and collaboration

Customers are asked to move tiles on a screen to show which brands they like or dislike and the results are used to build a detailed profile on that person. That profile, called an autograph, is fed back to the consumer to ensure it is accurate and they are then sent targeted offers.

The campaign won the mobile category at this year’s Data Strategy Awards.

Henry Lawson, chief executive at nFluence, says: “Consumer-powered marketing is putting the power back in the hands of consumers. We are finding that if you give the power back to the consumer, a level of trust will develop with brands that makes for a more productive relationship.”

Lawson believes that most personal data services have a low take-up. So these services, many from start-ups, are still in the first stages. However, schemes such as Cheap Energy Club have over 1 million members.

Shadbolt at the ODI says: “It is early days and it will be wrong to believe that the personal data economy is mature, but I think we will see it move very quickly. It will be counter-productive if [brands] do not have a play or a corporate view about how they place themselves in this new data exchange that will happen.”

Five emerging players in the new information business

1. Safeplug is a device that plugs into web routers in the home, routing all internet traffic through Tor, an anonymous network, so that all web browsing can be private. Made by Cloud Engines, a San Francisco-based company that has had more than $31m (£18.6m) in funding since 2009.

2. Datacoup enables consumers to sell their data back to brands. It claims: “while large enterprise gets wealthy from monetising our personal data, we, as consumers, are left with little more than a targeted ad. Datacoup equips the user to control the distribution of their own data”.

3. MyPermissions shows people which apps have access to their personal information, sending alerts when they try to access data and creating a ‘trusted apps’ list. Time magazine voted it one of the best iPhone apps last year.

4. Handshake lets users negotiate a price for their information. In beta at the moment, it claims that it “cuts out the middle man and has been designed for people who recognise their personal data has serious value”.

5. Ghostery has a ‘knowledge library’ of about 1,800 ad networks and publishers and shows people which ones have information on their web browsing habits. ‘Are there some marketers you trust, but others you’d rather turn away?’ it asks. The service enables users to block any of the companies that track them.

Case study

Cheap Energy club

An early example of the shift towards people taking control of their data is the Cheap Energy Club from consumer website MoneySavingExpert.com.

Using the energy consumption details of each user, the service cross-checks the entire energy market to make sure consumers are on the best deal.

It requires the user to input their current tariff data and state the amount of saving for which they would be willing to switch supplier.

Available tariffs are reviewed each month and users are alerted when switching supplier would trigger their target saving, creating a fundamental change to the usual relationship between consumers and brands.

Archna Luthra, clubs manager at MoneySavingExpert.com, says: “Part of the reason why we started the energy club was because our founder, Martin Lewis, was going out telling people how to save on their energy bills and they were coming back and saying to him ‘can’t you do it for us?’

“From a data point of view, it is shifting the power back to the consumer with this data and the information that we have in terms of their tariff. It allows us to monitor their tariff and alert them when they can save and it takes the legwork out for them.”

The scheme, which launched in February 2013, has over 1 million users.

How brands can be part of the ‘personal information economy’

A large European retailer is preparing to announce plans to give its loyalty card data back to its customers, who will be able to use this data to connect with retailers and other advertisers and suppliers. The data will be hosted by an independent personal data store. It is a big project – starting as a trial, with planned roll-out over three years.

The personal data economy aims to turn around conversations about data. It is no longer about how much information brands can collect on customers, but customers managing the data that brands have and the information they are willing to share.

With many types of personal data services, the opportunities are apparent for brands to provide a better service for consumers and, more importantly, gain their trust.

Services range from data storage and management, where documents can be uploaded, tagged, searched and updated, privacy awareness tools to help people understand the data collected by companies, and permissions management for data sharing.

Data access is arguably where brands will see a fundamental shift in relationships with consumers with regard to data collection.

Big stats

77%

of people would provide companies with more information about themselves if they were sure that companies would not share it

71%

would do so if it helps them save money

60%

would do so if they received a service better tailored to their needs

56%

would do so if it means they had the information to make better decisions

Source: GfK

Viewpoint

Nigel Shadbolt

Co-founder and chairman

Open Data Institute

When we think about a data transaction between a government and its citizen or a business and a consumer, the interesting questions to ask are: where is the value in that, who is extracting value, and what new things can we do?

Consumers are waking up to the fact that there is huge amounts of information that companies are using to recommend services or segment them, but at the moment there is not much that the consumer is able to do – it is a passive relationship.

Consumers and consumer groups are starting to see the potential for empowerment and its through things such as price comparison, third-party aggregators and sites such as MoneySavingExpert.com where there is value in being more informed.

Companies need to recognise the inevitability that consumers will get more information about their buying habits. Whether or not it comes from the retailer or the provider of a service, there will be other ways they can get it.

The personal information asset is huge but is it a new opportunity to empower consumers to make better buying decisions? One would hope so. What you hope it isn’t is a massive landgrab of our individual data only for the benefit of the company.

Data is an amazing raw material which, if made available in an appropriate way, is going to change the economic and social landscape.

How successful will the personal information business be?

- Consumers’ willingness to share information is significantly higher when dealing with a named brand versus a generic supplier.

- Compared to situations where data policies are not mentioned, consumers are more willing to share information when explicit assurances are made as an integral part of the interaction and people feel more attached to the brand.

- There is a rise in the number of people happy to share information if there are additional assurances, but only up to a point. If numerous assurances are offered, for example, ‘we operate at the highest levels of data security’, ‘we won’t use your data for purposes you have not agreed to’ and ‘we will not share your data with third parties’, people become less willing to share information.

- When consumers are reminded of the dangers of indiscriminate data sharing, which is common nowadays with media coverage of data issues, they perceive the brand they are dealing with as more distant, creepier, less protective, more invasive, less efficient and less honest.

Ctrl-Shift and GfK surveyed 300 consumers using a range of storyboards featuring online transactions. In some there was no mention of the company’s data policies, while in others, explicit assurances were made. They tested these alternatives in different contexts, some branded and some generic.

Sources: GfK, Ctrl-Shift

References

- ^ Five emerging players in the new information business (www.marketingweek.co.uk)

- ^ How brands can be part of the personal information economy (www.marketingweek.co.uk)

- ^ see Viewpoint, below (www.marketingweek.co.uk)