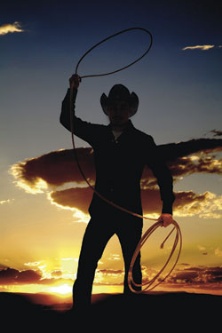

Is the online advertising market still a 'wild west'?

How can a brand ensure its online ad campaigns end up in front of the consumers they were intended for 100 per cent of the time? Michael Barnett learns how to remain in control of the placement process

Uncontrollable, inhospitable and bewildering might sound like a description of the Wild West, where it’s every man to himself when it comes to keeping safe. But the same description can also be applied to the internet, which is still a dangerous place for brands – despite increasing regulation keeping cowboys in check.

Misplaced advertising and a lack of accurate data on where ads have actually run during a web campaign is turning some marketers off using online display altogether.

Rowan Gormley, Naked Wines

Rowan Gormley, the entrepreneur who was Sir Richard Branson’s right-hand man at Virgin and founded Naked Wines in 2008, says he has lost faith in ad networks and has stopped doing traditional online advertising after several unsuccessful attempts.

“I don’t think the ad network actually knew what it was selling. All the people at the network were interested in was closing a deal, and they weren’t that interested in whether it worked for us or not.

“I think a lot of their advice on pricing was motivated by the commission they were going to earn, rather than whether there was any long-term chance of success. I think it is an industry that has an awful lot of sales people and very little expertise.”

Instead, Gormley favours affiliate relationships where there is direct contact with another online business, and a mutual interest in helping each other acquire new customers (see Viewpoint, below).

One of the reasons why brands like Naked Wines are moving away from the channel is ads appearing on inappropriate sites, which has been a concern for others too.

Last year, ads from Tesco and BT appeared on pirate TV and film websites, according to the Federation of Copyright Theft, which suggested they were indirectly funding these websites. The big brands responded by saying that it is difficult to know where their ads might be placed.

To take a snapshot of the state of online advertising, and whether brand owners are aware of which sites their campaigns appear on, Marketing Week has analysed a sample of 50 pornographic websites selected at random.

For one brand – online gaming company 888 – these sites are still causing problems, despite an article in Australia’s Sunday Telegraph newspaper in February. It found that 888’s brand ambassador, Australian cricketer Shane Warne, was appearing in 888 ads on porn sites.

Warne’s manager James Erskine, of talent agency Sports and Entertainment Limited, denied at the time that he or Warne knew where the ads were running, and he tells Marketing Week that he raised the issue with 888 following the story.

He says: “888 had given us assurances that all their advertising was withdrawn from adult sites.”

Adult sites

But almost half the non-pornographic ads or affiliate links that were found by Marketing Week’s research into adult sites – 13 out of 27 – were for 888. These included links to web pages featuring Warne.

In a statement, the company replies: “Pop-up banners featuring Shane Warne were removed from all adult sites in February this year. Due to very rare technical issues relating to geographical targeting, a banner may have defaulted to the 888 homepage, which does feature Shane Warne. An extra fail-safe has now been added to ensure that this cannot happen going forward.”

Although 888 says it “does not directly work with or display on adult pages”, the ads seen when clicking links on adult websites during Marketing Week’s research appear to have been placed by companies that 888 employs to serve pop-ups to targeted audiences.

After 888, the next highest proportion of non-adult ads served was for competitor Betfair. As well as pop-ups, these included banner ads displayed on the sites themselves. Ads from PartyPoker, owned by gaming group and Real Madrid sponsor Bwin, also appeared as pop-ups triggered by the surveyed sites. Only two ads were from non-gaming companies.

Neither Betfair nor PartyPoker responded to requests for comment, so it is unclear how the ads were bought. Since both run affiliate programmes, where other websites are rewarded for convincing their users to become paying players, it is possible they were placed in this way. But both brands state in their terms and conditions that affiliate partners must not host their ads on pornographic websites, or authorise other partners to do so.

Different companies tolerate varying levels of control over their online marketing, and some may want to appeal to people who visit porn sites, but it is clear that the Wild West of the internet is open to ads appearing where they shouldn’t be seen, as in the case of 888’s ads featuring Warne.

“The internet is more like a city than the Wild West. You enter with the best intentions but can mistakenly take wrong turns”

Gareth Holmes, PubMatic

Since the majority of the time brands do end up on the sites they pay for, it is an exaggeration to refer to the internet as the Wild West, according to Gareth Holmes, publishing director of ad platform PubMatic and a member of the Digital Standards Trading Group (DSTG), an independent body promoting best practice in online marketing.

He does not speak for the DSTG in an official capacity, but says: “The internet is more like a city than the Wild West. You enter with the best intentions but can mistakenly take wrong turns. If you are new to media buying or there are not sufficient internal controls, you can take the wrong turn and end up working with what, on the face of it, looks like a credible source of advertising inventory but may well be less than desirable. If it’s cheaper than it should be, there’s a reason.”

There are a variety of circumstances in which a brand’s ad might end up in undesirable locations on low-quality sites. Ad networks risk losing business if they don’t place a certain number of ads, but changes in demand can push up the price for the ad space where a brand originally wanted to run, leaving the network to find cheaper alternatives.

“Less than credible ad networks will take the order then try to buy inventory, often caring little about the appropriateness or the impact on the brand,” says Holmes. “Desperation drives actions that can, and have, affected the appropriateness of inventory the campaign is delivered against.”

Clear view

Having a transparent view at the brand and agency levels of all the possible sites where ads and links could appear seems to be the only reliable way of ensuring an ad doesn’t appear where it shouldn’t. But even this can be difficult.

Electronic log files should exist that can show where every impression ran during a campaign, but these can be difficult to obtain, especially if the network is unable to provide individual customer service to every advertiser.

One ad network told Marketing Week that about half its clients specify that their ads should only appear on premium websites. But Holmes points out that even if ad space on the sites of well known media owners is regarded as premium, this does not always mean it will be appropriate. For example, an ad network could use targeting technology to place an ad for an airline against an aviation story on a high-quality news website, but if that story is about a plane crash it is the worst possible place for it.

Rachel Waller, digital marketing manager at online luxury fashion retailer Farfetch.com, points out that the specific context of the ad placement is as relevant to its appropriateness as the general categorisation of the site’s content. The media owner’s brand must also be a fit for the advertiser’s.

“Ultimately, relationships with publishers are only valuable when they are relevant to your business – that way you know that you are reaching the right audience in the right way. For us, it’s about understanding luxury consumers and where they might go to look for designer brands. These are the sites where our presence is valuable and has a high chance of being converted to a sale.”

Waller says Farfetch uses a combination of online display ads, search ads and affiliate links, and that the company goes to particular pains to ensure its affiliate partners are suitable, in collaboration with its agency Rakuten LinkShare. This is especially important because Farfetch’s business model is to act as a retail channel for small luxury boutiques, so it must look after their brands too.

“Consumers often build an image of your reputation by looking at what other brands you are associated with, so we’re conscious that our relationships with the publishers and sites we work with represent our brand.

“We have also to be extremely careful about where our brand appears, so that we are adequately representing the independent luxury boutiques we work with and the designer items they sell.”

Keep active

At sports equipment retailer ActivInstinct, chief executive Mike Thornhill says that achieving certainty about brand protection from online advertising and affiliate partners requires constant attention, and sometimes abuses slip through the net.

Affiliates usually earn a commission for each paying user they send to the client brand, so some will pretend the brand is offering discounts, to get users to click through to its site. The Office of Fair Trading also recently instructed the MoreNiche affiliate network to suspend affiliates that ran misleading promotions, for example disguising paid-for links to other sites as independent customer reviews.

“The last thing we want is a customer calling and saying they have seen a deal that isn’t there – you don’t want to let the customer down but it is not something you have promised personally.”

“We have lots of online alerts set up so we know where people are mentioning our brand, and we have someone that manages affiliates. You unfortunately have to police it quite tightly, just so you aren’t being shown inappropriately and people aren’t making claims about your brand.”

The complexity of the affiliate market can make it difficult to monitor, because affiliate sites often have unusual business models. For example, Yipiii.co.uk, an affiliate partner of retailers such as Amazon, Boden and La Redoute, allows users to play to win items sold by its clients before buying them.

The site has a gaming licence, and this led the Mail on Sunday newspaper to accuse the business of luring shoppers into gambling, although it is possible for users to redeem anything they lose as discounts on purchases. A third of Yipiii’s retailers pulled their products off the site as a result (see case study, below).

In mobile advertising, it can be even more difficult for a brand to lay down the law to ad and affiliate networks than when buying space on websites optimised for desktop computers.

Indeed, “girls games and gambling” have been ways to make money from mobile advertising, according to one industry expert.

The industry is relatively new, meaning that many media brands have not yet fully developed their mobile sites or their offering to advertisers on those sites.

This is the reason why Stardoll Media, which owns teen gaming sites Stardoll.com and represents Roblox.com, has not yet fully exploited the mobile advertising space it owns, according to commercial director Stephen Molloy (see Q&A, below). Media owners have their own brands to look after too, so taking any advertising to fill space indiscriminately is likely to be just as harmful to Stardoll’s brands as it would be for an advertiser to place its ads in a similar slapdash way.

The upshot of mobile advertising being an immature market is that options for brands are not yet abundant. There is therefore a significant price difference between high-quality inventory and the rest, and as with general online ad inventory, buying it cheap can lead to ads ending up against inappropriate content.

Specialist bike insurer Bennetts is now moving away from online advertising, building its digital strategy around pulling in users with its own website content. The company’s affiliate spending is currently flat year-on-year, while its spending on website display ads has fallen 26 per cent, according to marketing and ecommerce director Hannah Squirrell.

“We want our website to be so compelling that people come to us, and that we don’t have such a necessity to be advertising on sites owned by others that are more difficult to control. We are a premium brand, and we are extremely conscious of where our advertising is shown.”

Bennetts currently uses online advertising for both awareness and sales generation, but Squirrell says it is important for the brand to have the confidence both of knowing exactly where advertising is being placed and also of making sure it is providing positive sales results. For this reason, the brand is very selective about the traffic it seeks to attract through advertising and affiliate links.

“We have moved away from sales-driven affiliates – those that use very heavy cashback offers. We never discount our core product as we are a premium brand. The insurance market is in a price war, but we are not a part of it and we wouldn’t want people putting our brand on very downmarket websites that could be detrimental to us.”

Squirrell says that the format of Bennetts’ online display advertising will also be focused on generating traffic to its website only from very hot sales prospects. Banner ads will allow users to fill in details to begin a quote from within the ad. Clicking through will then take the user to an application form on the Bennetts site already populated with the answers previously entered.

“People are not going to go to the effort of filling in those questions if they have no intention to buy,” she says.

Being as selective as Bennetts about seeking web traffic won’t be the right strategy for every brand - especially not those that depend on customer volume as opposed to premium positioning.

But two things seem clear when placing ads online. First, for complete transparency about the sites where ads appear is the only way of ensuring they end up in front of the consumers they were intended for 100 per cent of the time. And second, if it seems too cheap to be true, it probably is.

Case Study: Yipiii

Yipiii.co.uk is an affiliate site with a unique business model. Encompassing both shopping and gaming, it is hard to categorise, and in recent times that uniqueness has worked both for and against it. Unfamiliarity can be frightening for brands when online marketing is strewn with unsavoury and unscrupulous characters.

In June, the Mail on Sunday surprised Yipiii founder Christoph Klinger with a call demanding to know how many millions of pounds he made from his seven-week-old start-up business. That weekend, the newspaper ran a front-page story accusing the business of preying on consumers by giving them a chance to gamble on goods before electing to buy them.

Two journalists claimed to have spent £162 on the site and won only a £20 goldfish bowl, when in fact one had won an iPad using free plays and the other had spent £40 and won an iPod and a £35 bouquet of flowers. After being presented with the evidence, the newspaper apologised.

The damage was done, however. On the day the Mail on Sunday article ran, one-third of the retailers providing products on Yipiii withdrew their business. They included brands such as Boots, Asda and Sainsbury’s. But others have since come trickling in to replace them, and some big brands – including Amazon, La Redoute and Boden – are still there.

“With the light shining on us, we have got many new retailers on board - mid-sized and smaller ones,” says Klinger.

Players pay £1 each time to spin a wheel and play for a prize. They can win either the product itself, entry into a competition or free plays to try again.

If they lose, the £1 plays can still be refunded in the form of a discount, provided that the player is happy to use it on other products from the site. Yipiii says that 85 per cent of users’ stakes are returned in prizes, with the rest refundable when making purchases.

Klinger claims that retailers using the site as an affiliate sales channel are doing so with their eyes open, and are accepting of its business model.

Yipiii buys any product won on the user’s behalf, so whether consumers buy or win the goods, it counts as an incremental sale for the retailer.

Sports equipment retailer ActivInstinct lists products on Yipiii, and chief executive Mike Thornhill says that, while the company has ended affiliate relationships before, the Yipiii controversy did not reach his radar. “We have had a couple where we have had to close them down pretty quickly because of what they were saying and the claims they were making. It is usually where they make up discount codes, or say ActivInstinct has an offer on to get people to click through to the site.”

Klinger’s eventual aim is to have Yipiii’s wheel embedded into as many sites as possible, so consumers could attempt to win any product imaginable before deciding to pay the full price. There’s a long way to go, as consumers and brands still aren’t fully familiar with the site’s principles.

“When we first started we had a terrible bounce rate because people weren’t looking for it. But it has the potential to become part of your daily shopping habit,” he claims.

Klinger says 17.5 per cent of site visitors now register for an account and 4.6 per cent of registered users then go on to put cash in their Yipiii accounts. His short-term aim is to grow the number of users from around 4,000 a month to 500,000 a month by the year’s end.

His explanations haven’t yet won round anti-gambling groups, and even business secretary Vince Cable joined the chorus of disapproval after the Mail on Sunday article. But more importantly, Klinger needs to persuade retailers they have nothing to fear from this new affiliate model.

Q&A

Stephen Molloy

Commercial director

Stardoll Media

Marketing Week (MW): How do you ensure inappropriate ads do not appear on Stardoll Media’s sites Stardoll.com and Roblox.com?

Stephen Molloy (SM): The most important thing when working with ad networks is ensuring that we have extremely tight control over the creative process. We have a very strict block list, so there are absolutely no ads for gambling, alcohol or anything related to sex on the site – it is done by category. With such a high proportion of our users being young, they must never get exposed to those advertisements.

MW: How important is it for advertisers and ad networks to understand publishers’ audiences?

SM: Depending on the number of sites in an ad network, it does become harder to understand all of the different audience groups. In our instance, it is much easier to do because we have a very defined audience and demographic groups.

That’s what we do, and that’s what we’re experts in. We work with large blue-chip brands that are also themselves experts in dealing with the younger demographics – the likes of Disney, Paramount, Nintendo and Xbox.

MW: How do you ensure ads appearing on Stardoll Media’s sites are a good fit for its own brands?

SM: We have a direct sales team that is entirely focused on the advertising operation, and we therefore have a very clear focus on the advertisers we are going to target, and the most relevant ones. We are always talking to the advertisers that are a natural fit for us.

We have a dedicated ad operations team including designers and illustrators that are creating ads for our clients, so that means the ads are in-keeping with the look and feel of the site. It is extremely tightly aligned with our audience.

MW: How does your mobile advertising inventory differ from your desktop websites?

SM: Mobile is much newer territory for us. At this stage, it is about ensuring that the product is the right product for mobile, which should serve a different purpose from what we offer on Stardoll.com or Roblox.com. We do sell mobile inventory, but it is super early days.

There are banners within the Stardoll mobile apps and we have sold them, but we haven’t reached the same scale as Stardoll.com. We have 187 million members today, so you would hope that when we do we will have a solid understanding of teens around the world.

Viewpoint

Rowan Gormley

Founder

Naked Wines

We do no traditional online display advertising. We tried very hard to make those types of adverts work, but there is lots of hot air, impressive PowerPoint presentations, spectacular graphs and no sales.

We found ourselves with adverts appearing in places we didn’t want them, or else appearing in places that drive the wrong sort of traffic. The people who buy wine by the case tend to have an average income of £60,000 a year, and they are professional managerial people. So youth sites and porn sites aren’t appropriate to us.

Porn is an exaggeration, but they were often tacky, poorly put together sites that obviously generate traffic through dubious use of other people’s search engine terms.

We work directly with our affiliates. Because it is a two-way relationship, there is not much point in the other party trying to manipulate their circulation figures. People in the affiliate business understand pretty well that unless they deliver results, the relationship isn’t going to be a long one.

If you are speaking to the owner or marketing director, they are not really trying to get a quick sale out of you. They want to drive the success of their own business and the long-term relationship for their own selfish reasons. We have tried to work with agencies, but it has never delivered, so we have always ended up doing it ourselves.

An online strategy isn’t something you can just buy off the shelf. We have just launched in the US, where the affiliate market is much more developed. We thought that we would be able to plug into the market over there, but it turned out that in America there are endless contracts and nobody sticks to the terms of the deal.

If we bought space on someone’s page at arm’s length, we would find that what was promised wasn’t being delivered. The ad was in the wrong location, or it was supposed to be the only one there but there were actually 15 others. Once we started talking to people directly, we started building a much more mutually rewarding relationship.

When we contacted a company that was selling gourmet coffee and said ‘how would you like some wine to incentivise people to sign up to your gourmet coffee subscription service?’, they were five times more excited. Instead of earning a few thousand dollars by putting an ad on their site, they are actually generating more coffee drinkers, which ultimately is what they are really in business to do. By giving them a better return on their space, we end up with a much more positive relationship.